August Monthly Investment Update

Source: Blueprint Investment Partners

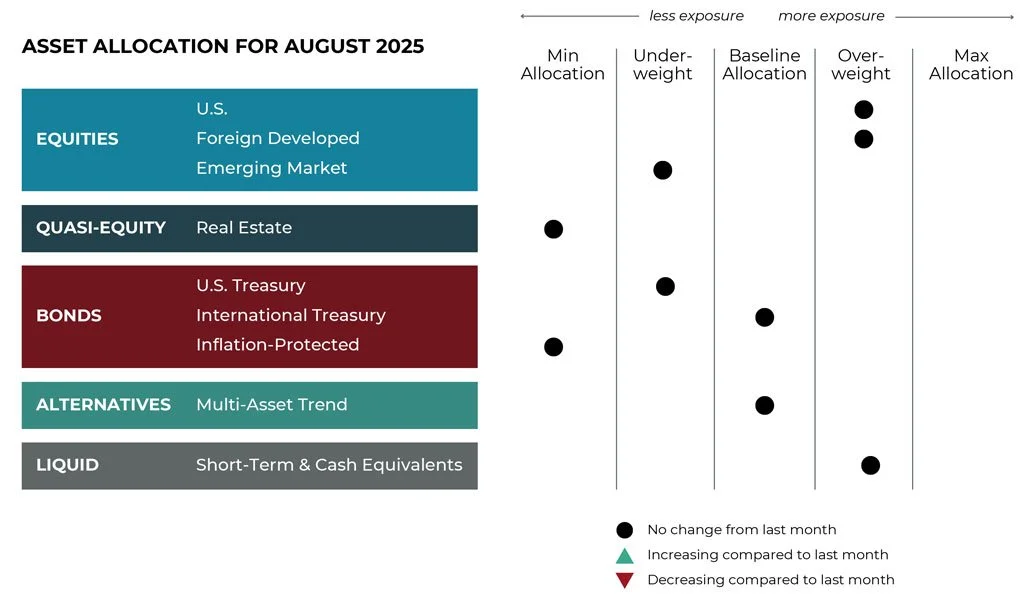

Adjustments can vary across strategies depending on each strategy's objectives. What's illustrated above most closely reflects allocation adjustments for the Growth Strategy. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Diversification among investment options and asset classes may help to reduce overall volatility.

U.S. Equities

Exposure will not change and remain overweight. Both the intermediate- and long-term trends are positive.

International Equities

Overall exposure will not change and remain at baseline. Trends continue to be positive across all timeframes and tilted toward foreign developed equities given its relative strength.

Real Estate

Exposure will not change and remain at its minimum.

U.S. & International Treasuries

U.S. exposure will not change and remain underweight. Trends in the middle part of the U.S. Treasury yield curve are positive while the long-term end is negative. International Treasuries are still in solid uptrends, and their overall allocation will remain at its baseline allocation.

Inflation-Protected Bonds

Exposure will be at its minimum. Trends are still positive but the group has weakened versus other fixed income assets.

Alternatives

Exposure is expressed through a multi-asset alternative ETF. Bonds (net long) continue to hold the most influential allocation, now followed by stocks (net long). Commodities remain slightly net long as well. The currency portfolio remains net short the U.S. Dollar.

Short-Term Fixed Income

Exposure will not change, having previously absorbed exposure from weaker, higher-duration bonds.

MONTLHY NOTE

Restraint (Not Reaction) Can Be The Clearest Expression of Discipline

“Don’t just do something — sit there.” – Sylvia Boorstein

One of the hardest things in investing is doing nothing — not out of neglect, but on purpose.

At Miller Wealth Partners, we believe in acting when conditions warrant it — and holding firm when they don’t. That’s the nature of a rules-based process: trade when the data says to, and stay put when it doesn’t.

This is one of those times. With both market activity and portfolio adjustments remaining minimal, our strategies haven’t needed to shift. And that’s not a sign of weakness — it’s a sign that our positioning is aligned with the current environment.

In this month’s Note, we reflect on the value of staying still when the system calls for it — and why restraint, not reaction, is often the clearest expression of discipline.

But first, here’s a summary of what transpired in the markets in July.

Asset-Level Overview

Equities & Real Estate

For the second consecutive month, U.S. equities have enjoyed low volatility uptrends, extending the benchmark index to new all-time highs after the strong close to June. As expected, trends across all timeframes remain positive, and as a result, our portfolios are nearly fully invested. Moreover, U.S. equities continue to hold exposure previously passed on due to weakness in other quasi-equity segments, such as real estate securities.

After a brief lull, international stocks picked up steam in July, also extending their entrenched uptrends. Like U.S. equities, our portfolios remain near their baseline allocations abroad, with a tilt toward developed markets. While international equities still lead in terms of 2025 performance, the outperformance gap between the group and U.S. stocks has closed slightly over the last 60 days.

Among the equity and quasi-equity allocations, real estate remains weakest. Trends are slowly heading toward a positive direction, but the asset class overall remains in a tight range that is well below all-time highs last seen in late 2021.

Fixed Income & Alternatives

At a high level, fixed income performance remains locked in the same pattern. Short-term up to intermediate-term bonds continue to slowly churn mostly higher, while long-term bonds remain weak. This is generally the case whether one is looking at U.S. fixed income or abroad. The mixed results leads to a varied portfolio, with material exposure to the short-duration side of things and almost no exposure on the long end.

Within the multi-asset trend alternatives bucket, short-term fixed income futures and other related instruments remain the most significant in terms of allocation. Longer-duration bonds continue to be primarily held in short positions. Commodities, such as gold and cocoa, also make up noteworthy positions. Meanwhile, the continued strength in stocks globally has caused net long exposure to increase there as well. The U.S. Dollar’s steady decline has caused this segment to increase allocations to foreign-denominated currencies.

3 Potential Catalysts for Trend Changes

Fed Funds: The Federal Reserve held rates steady for a fifth straight meeting. However, it faced unusual dissents from two officials who voted for an immediate cut. The decision comes after a period of intense political pressure to lower rates coming from the White House and placed on Chair Jerome Powell. Officials maintained their benchmark policy rate in a 4.25% to 4.50% range. Important considerations in the decision was how importers, retailers, and consumers divvy up the costs of higher duties on imports. Powell said the Fed wants to ensure any one-time increases in prices do not lead to persistent inflation. The Fed’s caution is fueled by mixed economic reports: Q2 gross domestic productwas higher than expected at 3%, a measure of private business and consumer demand recently decelerated to 1.2% from 1.9%. The Federal Reserve meets again in September, and the next rate decision could be straightforward if data breaks decisively in either direction. Sticky inflation readings combined with solid growth would make it easier to defer rate cuts, but clear economic deterioration would justify cutting the base rate.

Jobs, Jobs, Jobs: U.S. initial jobless claims declined, extending a period where layoffs have remained constrained. During the spring of 2025, there was a rise in initial-claims filings, but that has reversed course during the past several weeks. The new data is calming concerns about the labor market being weakened. However, evidence from recent monthly job reports shows hiring has slowed. Given the uncertain path forward due to trade policy swings, many companies are postponing major decisions about hiring and investment.

No Home Sales: Home prices rose to a new high in June. With the critical spring sales season fizzling, it is an indication that a housing-market recovery is unlikely this year. June sales fell to a nine-month low. The combination of record prices and mortgage rates above 6.5% has made home purchases unaffordable for many buyers. The national median existing-home price in June rose to $435,300, setting a record going back to 1999. Additionally, more than one in four listings on Zillow saw a price cut in June, which is the highest proportion for any June since at least 2018.

Sourcing for this section: The Wall Street Journal, “Fed Holds Rates Steady, but Two Officials Back a Cut,” 7/30/2025; The Wall Street Journal, “Fewer U.S. Jobless Claims Were Filed Last Week,” 7/24/2025; and The Wall Street Journal, “Home Prices Hit Record High in June, Dragging Down Sales,” 7/23/2025

Stability Impacts Returns, Behavior & Taxes

“Muddy water is best cleared by leaving it alone.” – Allan Watts

Tactical strategies are often heralded for their emphasis on risk management and the ability to make adjustments before or during market shifts. In that sense, it is the times of change that set us apart from nontactical managers.

With that said — and this might surprise — it is actually lack of change that we prefer. This is especially relevant now, as the calendar flips from July to August and both market activity and portfolio adjustments remain minimal.

Why? Because our systems hunt for trends — but once those trends are established, the best results often come when portfolios don’t need to be reallocated.

There are two facets to this phenomenon:

1. Low volatility is highly correlated with positive performance. When markets are quiet, particularly in equities, returns tend to be stronger.

2. Trend following can be designed to tilt more heavily toward stronger assets. When those trends persist, the resulting positioning can generate alpha relative to passive benchmarks.

A great example is 2024: Stable uptrends not only contributed to strong performance, but also enabled portfolios to overweight areas like technology and growth stocks — positioning that generally led to outperformance.

Now, someone might ask: If the best performance occurs when portfolios don’t change, why not just use a passive or strategic allocation approach?

Because when markets do fall, losing less through tactical positioning can mean winning more over time.

An often-overlooked principle illustrates this: Not all declines are created equal when it comes to recovery. A 10% decline requires a little more than a 10% gain to return to breakeven. But a 50% decline? That requires a 100% return to recover — not to mention the emotional toll it takes on investors.

This is why stability matters — and not just for returns:

Behavior: Most investors are suspicious of too much activity. Tactics, when misunderstood, can look like tinkering.

Taxes: More frequent trading (especially of winners) increases the chance of short-term gains, which can erode after-tax returns even when pre-tax profits are strong.

At Miller Wealth Partners, our strategies prioritize durability over short-term flash, because most client goals aren’t measured in weeks or months — but in years and decades. That means making tradeoffs. But they’re tradeoffs that we believe our clients understand and appreciate.

This year has had its bumps. The trends that supported us in 2023 and 2024 wobbled during the first half of the year. But June and July brought a welcome reprieve. As we move through the second half of summer, here’s to hoping that doing nothing — in accordance with our process — continues to be the right move.

Important Information:

Blueprint Financial Advisors (“Blueprint”) d/b/a Miller Wealth Partners is an investment advisor registered pursuant to the laws of the states of Florida, Georgia, Illinois, New Jersey, North Carolina, and Virginia. Our firm only conducts business in states where licensed, registered, or where an applicable exemption or exclusion is afforded. This material should not be considered a solicitation to buy or an offer to sell securities or financial services. The investment advisory services of Miller Wealth Partners are not available in those states where our firm is not authorized or permitted by law to solicit or sell advisory services and products. Registration as an investment adviser does not imply any level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. For more information, please visit adviserinfo.sec.gov and search for our firm name.

Past performance is not indicative of future results. The material above has been provided for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation.

Information obtained from third-party sources is believed to be reliable though its accuracy is not guaranteed.Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of writing and are subject to change without notice. The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission from Miller Wealth Partners.An index is an unmanaged portfolio of specific securities. The performance of which is often used as a benchmark in judging the relative performance of certain asset classes. It should not be assumed that past performance in any way relates to future results. An investment cannot be made directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown.